Case Studies > FinTech, On-Demand Apps, Visual IVR

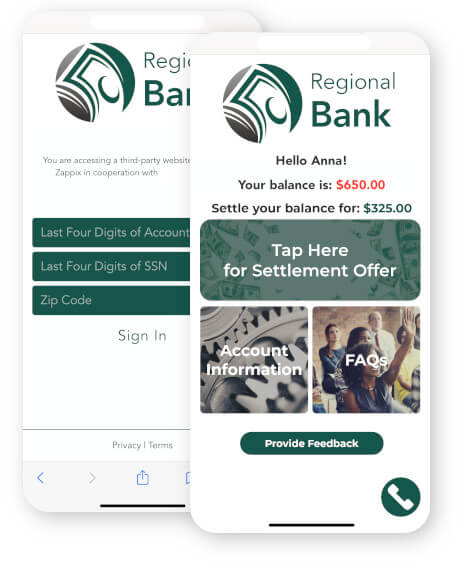

A large regional bank was looking to digitalize their customer interactions. They launched visual self-service to automate critical customer service functions like debt repayment plans and credit account management.

The bank found many of their customers preferred digital interactions, but critical customer interactions like viewing credit card balance, browsing applicable payment plans, and repaying debt lacked dedicated digital portals.

Ranked the nation’s best performing large community bank by S&P Global Market Intelligence in 2020, this regional bank has over 2,000 employees and has been serving customers for over 20 years. The company is also one of the top 15 largest issuers of MasterCard brand credit cards in the United States.

Zappix optimized customer interactions for key customer call types including: view balance, browse payment options, and submit payments. As one of the largest issuers of MasterCard brand credit cards in the United States, these calls made up a large proportion of the bank’s call center interactions. By implementing Visual IVR seamlessly integrated with the bank’s backend database, users can now securely pay off their balance.

Smart Zappix visual interfaces remove barriers to payment for customers by automating the payment process and reducing customer effort, while simultaneously presenting customers with the best options available to them. Dynamic Zappix user journeys show users the different offers and plans available to them based on user actions.

This combination of smooth, easy to use, automated interactions, and increased customer knowledge of payment plans means minimal customer effort and an increase in customer satisfaction.

The Regional Bank benefitted from several key features of the Zappix solution including:

Please contact us to set a call with our implementation experts

Zappix transforms the user journey during customer service interactions with an AI-Powered Digital Engagement Platform- engaging through Digital Outreach, deflecting inbound inquiries using Digital Self-service, and optimizing agents’ activities using Digital Agent Assist. The cloud-based platform enables workflow automation, rapid developments, and integration to back-end systems and provides an actionable Analytics Suite.

© 2024 Zappix, Inc. All Rights Reserved.